Not all businesses can be done online. Digital management of travel allowance made easy and mobile.

Stay up to date with national rates – always.

Easy ERP system import with relevant data input.

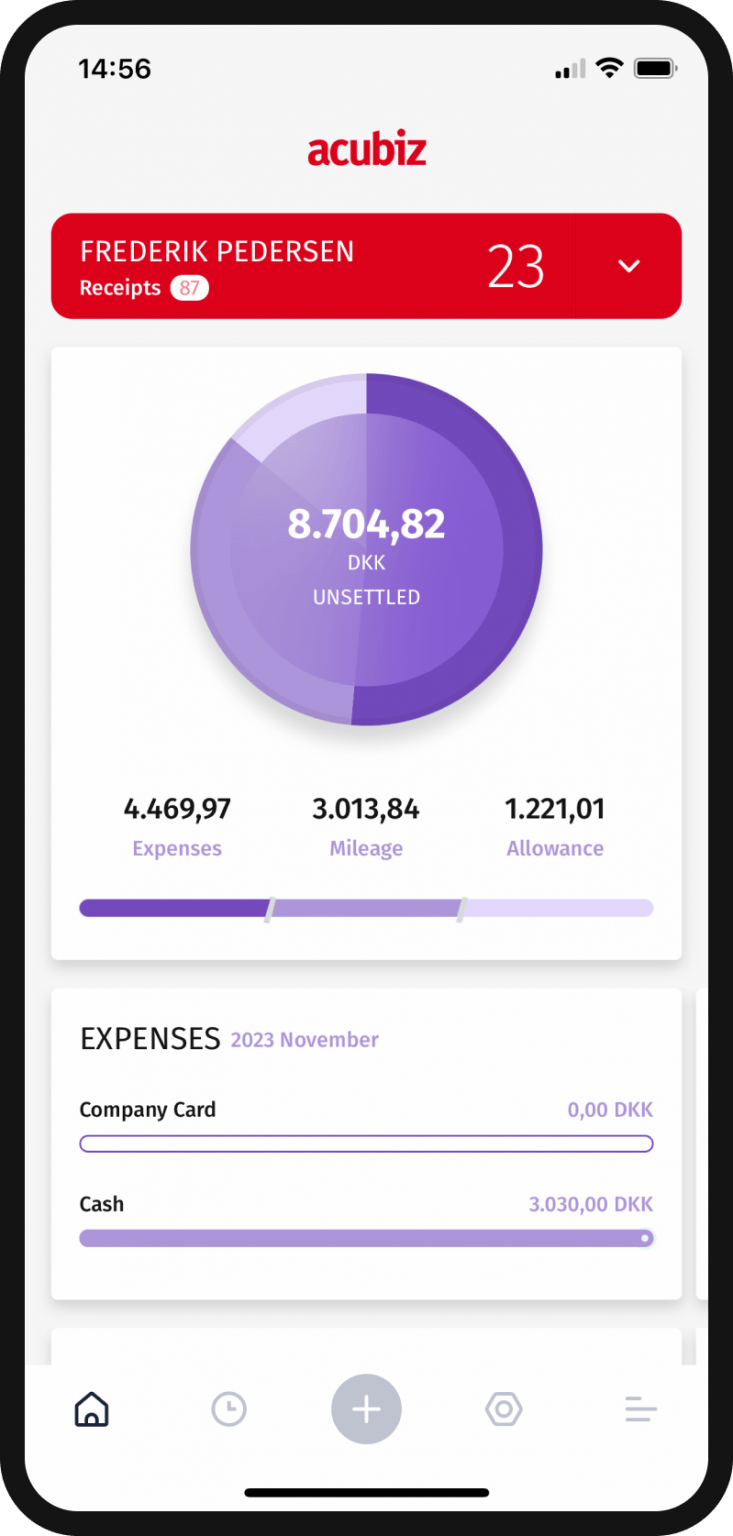

Add relevant travel information such as duration and destination.

Choose the meals needed for every day travelling.

The allowance registration will be added to the approval flow and sent for final processing.

Employers can choose to pay a tax-free travel allowance to cover the expenses associated with accommodation, food and other acquisitions that occur for employees when they travel for business purposes.

Certain conditions must be met for travel allowances to apply:

Employees can register their allowance in full compliance with national rates in Acubiz. We keep track of the rates – and update them regularly – which ensures that the reimbursement of the tax-free allowance is correct.

Päivi Karjalainen

Finansdirektør, HY+

Allowances are an amount of money that employers pay to employees to cover expenses related to business trips, including accommodation and meals. Other examples are vacation allowances and mileage allowances.