What is Accounting Act?

The Accounting Act is a law that sets rules and guidelines for the accounting of expenses and revenue items. The law applies to all business enterprises, associations, and organizations.

Make your bookkeping process more manageble with Acubiz

Make your accounting process more manageable and more straightforward by fx. allowing transactions from the company card to flow into the company’s financial system automatically.

The Accounting Act describes, among other things, the requirements for storing accounting material. It is prescribed that all accounting documents must be kept for a minimum of five years from the end of the accounting year in question.

Accounting obligations

The Accounting Act primarily states that all business enterprises in Denmark, with the exception of government-led companies and municipalities, are required to keep accounts. This refers to the companies’ accounting obligation.

The law does not prescribe how the accounting should be carried out. It can, therefore, be done manually and with the help of online accounting programs or an internal accounting department.

The accounts are prepared continuously as the months progress and culminate in an annual report at the end of the year. Both must be submitted to the Danish Business Authority.

Changed legislation

Legislation changes continuously – and the same applies to the Accounting Act.

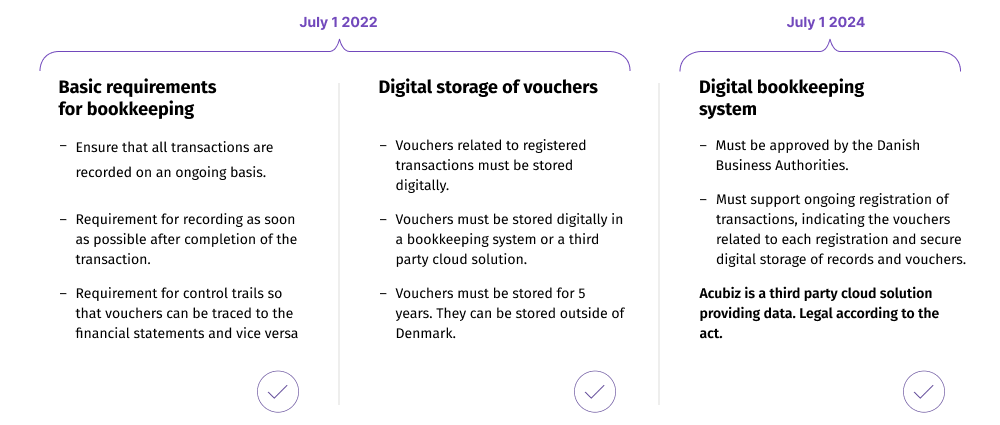

On July 1, 2022, the law was updated to accommodate the increasing use of electronic storage of documents and data, making it easier for businesses to use modern technologies for their bookkeeping.

The law imposes stricter requirements for digital registration and the use of approved digital bookkeeping systems, making Denmark a leader in the EU in terms of digital accounting requirements.

The purpose of the law is to ensure that companies’ accounts provide an accurate representation of their financial situation.

The new Accounting Act makes it mandatory for businesses to use digital solutions for their bookkeeping, which helps reduce errors and improve transparency. Digital bookkeeping also makes it easier to store and share accounting data, which can enhance collaboration between different departments and external partners.

What does the new accounting act say about digitization?

The new Accounting Act requires businesses to maintain electronic bookkeeping. This means that companies must be able to present accounts and receipts digitally.

This makes it easier for the Tax Administration to audit accounts and detect any errors or fraud.

Although the law is introduced for security reasons, there are many benefits to digitizing bookkeeping. Companies can, for example, use automatic bookkeeping and invoice management with an app, creating a digital and automated invoice workflow.

Electronic bookkeeping can also improve security by reducing the risk of data loss and protecting sensitive information from unauthorized access. Additionally, digitization can reduce administrative burdens and give employees more time to focus on strategic tasks.

New Accounting Act 2024 – Registrations and documents must be handled digitally

From July 1, 2024, companies in accounting classes B to D must handle the storage and registration of documents digitally.

For companies in accounting class A, this will become a requirement from July 1, 2026.

The digital bookkeeping system must be approved by the Danish Business Authority and support the continuous registration and storage of transactions and documents.

The requirements for a digital bookkeeping system are already set. It must support the continuous registration of transactions and the storage of registrations and documents.

Storage of registrations and documents can be done in a third-party cloud solution, as long as the company describes the procedures for how the solution handles the registration of transactions and the storage of accounting material.

Rules for bookkeepers according to the new Accounting Act

Bookkeepers and others who perform bookkeeping work for companies are also subject to the new rules.

If you use a specially developed or non-registered bookkeeping system, the rules will come into effect later. This means that the requirements for, for example, limited liability companies (ApS) and public limited companies (A/S) will only apply to the financial year starting January 1, 2025.

You can see the full schedule on the Danish Business Authority’s website.

The new Accounting Act leads to increased control of accounting materials

Previously, the Danish Business Authority only audited the submitted annual report. With the new rules, the Authority can request to see detailed accounting materials. They can even involve the auditor in the investigation and require a statement from them.

Companies that do not comply with the rules will receive a reprimand or an injunction, where the fine amount depends on the company’s turnover. In extreme cases, there may also be the possibility of forced dissolution of the company.

Minimum Requirements Announcements

The Accounting Act describes the rules for bookkeeping in Denmark, which are important to know if you run a business.

The Minimum Requirements Announcements outline the guidelines for how a company’s tax-related annual accounts should be prepared correctly. All companies in Denmark are covered by the Minimum Requirements Announcements, which fall under the Accounting Act.

Minimum Requirements Announcements for Small or Large Companies

The Minimum Requirements Announcements are divided into two parts: one for small companies and one for large companies. The announcement for large companies has the strictest and most detailed rules for accounting.

If you are in doubt about which Minimum Requirements Announcement to follow, you should look at your company’s accounting class.

What is your company’s Accounting Class?

Danish companies are classified based on their size in accounting classes A, B, C, and D. Accounting Class A denotes the smallest companies where the requirements are basic rules for preparing accounts. Conversely, accounting class D is for the largest companies where there are stricter rules.

Here is more specific information about each accounting class:

- Accounting Class A

The size of the turnover is irrelevant, while personal liability is crucial. Examples may be sole proprietorship or partnership. - Accounting Class B

There is limited liability where you follow the same basic requirements as class A with some additional requirements supplemented. Examples may be joint-stock companies, commercial foundations, or limited liability companies. - Accounting Class C

Companies that do not fall under accounting class A or B and are not state-owned joint-stock companies or listed companies fall under accounting class C. Here, you follow the same rules as A and B, with additional requirements for C. - Accounting Class D

This concerns listed companies and state-owned joint-stock companies (regardless of size). Here, strict rules need to be followed.

For further information on the various requirements, you can visit the Danish Business Authority’s website.

Do you want to know more?

At Acubiz, we can help you with the digitization of your company’s expense management and integration with your company card and financial system. Learn more about what software integrations are here, or read more about the integrations options with Acubiz.

Contact us if you want to know how we can help your business or book a free online demo to learn more.