“It takes money to make money”. It’s a phrase that most people have heard before, and those who run a business or those who take care of the finances in a business, can probably easily relate to it. Of course, investments are needed to make something grow and of course there’re costs associated with running a business. A certain amount of a business’ operating costs is connected to the groups of employees that primarily drives the growth by securing the inflow of new customers, new revenue, additional sales to existing customers, billing of hours etc. These employees are typically salespeople, marketing people and consultants. These types of employees often have expenses when they’re doing their jobs. And we’re talking everything from representation, meals and drinks, ads and media buying, software subscriptions, transportation and travel expenditure and so on.

This blog post is not about the budgeting of these expenses or anything like that. No, it’s about the costs for handling and administering the expenses. Because it also costs money to keep track of the expenses. Yes, even though it sounds crazy, the fact is, that there’re costs associated with having costs. That’s because they need to be documented, controlled, approved, booked and accounted – all in compliance with applicable law as well as various company rules and policies. This blog post focuses on how this cost is lowered – or in fact, how this cost is lowered significantly, by putting expense management on autopilot.

The users’ terms

Described in short, the task is to implement a process, that makes handling, controlling, and bookkeeping of business-related expenses as simple, clear, and efficient as possible!

How is this task then solved? Well, it’s most effectively solved by using digital tools, that supports the task and provides flexibility, mobility and most importantly, meets the users (e.g. the types of employees mentioned before) on their terms!

Why is it so important to focus on the users? As I touched upon before, then it’s about minimizing the costs of all the administration related to the expenses. These costs are primarily composed by time consumption – by users, by managers and by the finance department. We need to work with the expense where it’s created and that’s obviously out there with the users. If we build a process, where we’re working with things retrospectively, then we’ve already burned too much time (and poured the first money down the drain). Because in this context, it always takes more time to work with things retrospectively. The best approach is to work with the expense once, on the spot – right away! So, we need the users to manage the expenses as soon as they occur.

The helping hand of automation

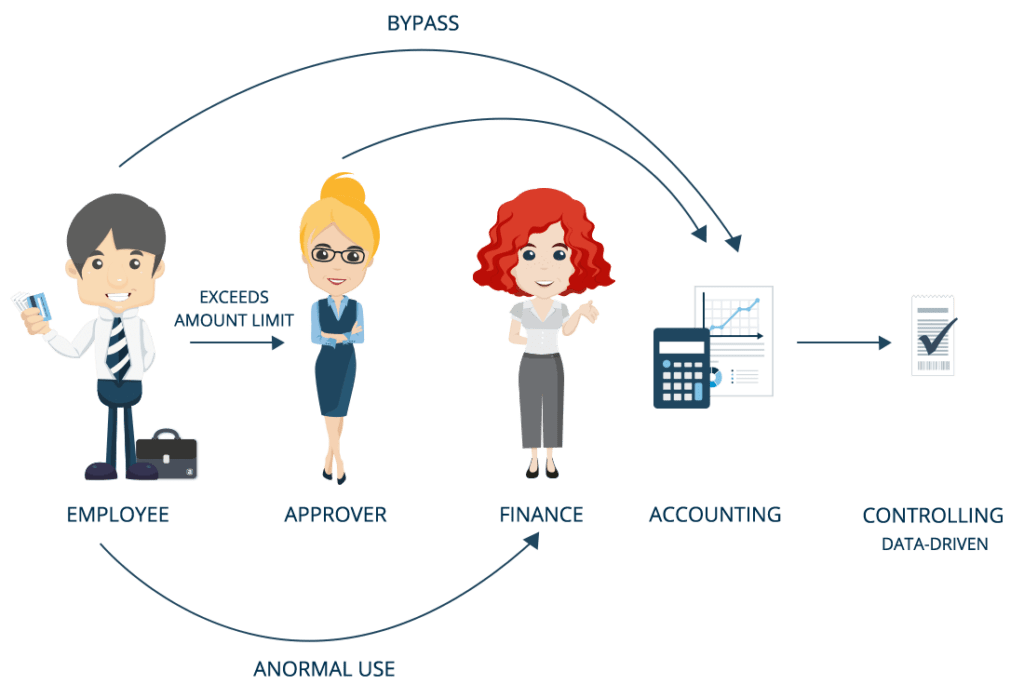

When it comes to those who need to approve the expenses and those who need to control and bookkeep the expenses, the costs are lowered by following the same principle as described above. This means that the focus should be on working with the expense once, however if it needs to be touched at all in these stages! Here, there’s really basis for saving time and to cross the finish line, automation is needed. That’s why it’s important that the digital tools that’s needed to support the task, can offer the right level of automation, as well as the ability to set up rule based controls of the transactions, thereby routing them down different routes in a workflow.

The point is, that managers and finance employees shouldn’t burn time (and thereby money) on unnecessary control and approval tasks. If an expense transaction is compliant with all documentation requirements related to appropriate bookkeeping, as well as all internal company rules and policies related to spend, then why not just have it recorded in the books right away? Focus must be on what’s essential and the non-essential must remain non-essential! Detailed control should instead happen later, through reporting and data analysis.

Dimensions and cost types

This is another area, where a large chunk of the costs related to expense management can be cut. As I touched upon earlier on, it’s crucial to eliminate too much subsequent processing of the expenses. Especially in the finance department. If bookkeepers or controllers needs to gather missing documentation and correct information about dimensions and cost types, then the costs related to process the expenses will see a significant increase. The reason for this is that this work is extremely time consuming, as requires getting hold of different employees and their managers and have them respond to stuff that has been executed in the past.

Again, we need to focus on the users, because it’s all about detailing the expense through essential selections, the moment it occurs! As such, we need the users to do dimension selections when they’re processing the expense, immediately after it has occurred. It’s crucial that dimension names are simplified and easy to understand on the users’ terms. There shouldn’t be any doubts and the dimensions must be maintained, so that unnecessary confusion occurs for the users. The same applies when we’re talking selection options for cost types – the way to go is to provide an easy and manageable overview of cost types and reduce doubt!

The cost types should be presented in an understandable format and on the users’ terms. It’s also an advantage to minimize the number of selectable cost types. In line with this, it’s also important that the digital tool that’s used to manage expenses can be configured to do conversions based on the defined dimension values, so that bookkeeping happens towards the correct finance accounts. Likewise, the tool needs to handle the configuration of correct VAT codes for specific cost types. Once again, it’s automation that does the magic. The users are presented with simple and intuitive choices related to an expense, and based on these choices, the transaction is automatically prepared for correct bookkeeping.

This is how it’s done

The below illustration shows the general approach to expense management on autopilot.

To sum up, the following building blocks are needed to put expense management on autopilot:

- Build the process around the users and a one-touch approach to handling the expense – as soon as it occurs.

- Make it easy for the users to submit and deliver the detailed information about the expense, as well and the documentation that’s needed to do correct bookkeeping.

- Let automation decide how many resources that’re used on subsequent processing of an expense – based on responsible logics, of course.

- Choose the right digital Best-of-Breed tool to support the process.

This is Best Practice with a solid Proof of Concept!