As the COVID-19 pandemic has gotten a firm grip of the whole globe, much has already been written about “The New Normal”. That’s the life with and after the pandemic in all sorts of correlations. Of course, you can also expect my perspectives on this. Therefore, the next couple of blogs from my side will be dedicated to deal with this topic, based on an Acubiz related context. Now, you have just read the headline for this post and might have thought; that doesn’t make sense, as business travel almost isn’t existing at the moment. If you’re thinking that, you’re actually wrong. Read on and find out why, when I’m looking into why a travel expense solution is of great use, even though there’s no business travel at the moment.

It’s about much more than travel related expenses

Fact is, that expense solutions like ours traditionally has been closely connected to business travel and several requirements related to this. I’ve been in this game for more than 20 years now, and the first versions of the solutions was indeed also specifically developed to support the process related to travel expenses. There’re many good reasons for this, because when it comes to this type of expenditure, there’s a huge need to ease the administrative work. This kind of image sticks and that’s also the reason why many finance decision makers, in the current situation, believe that technology for expense automation is obsolete right now. They simply think that the technology is closely connected to business travel activity and in particular, international business travel activity. However, that isn’t reality.

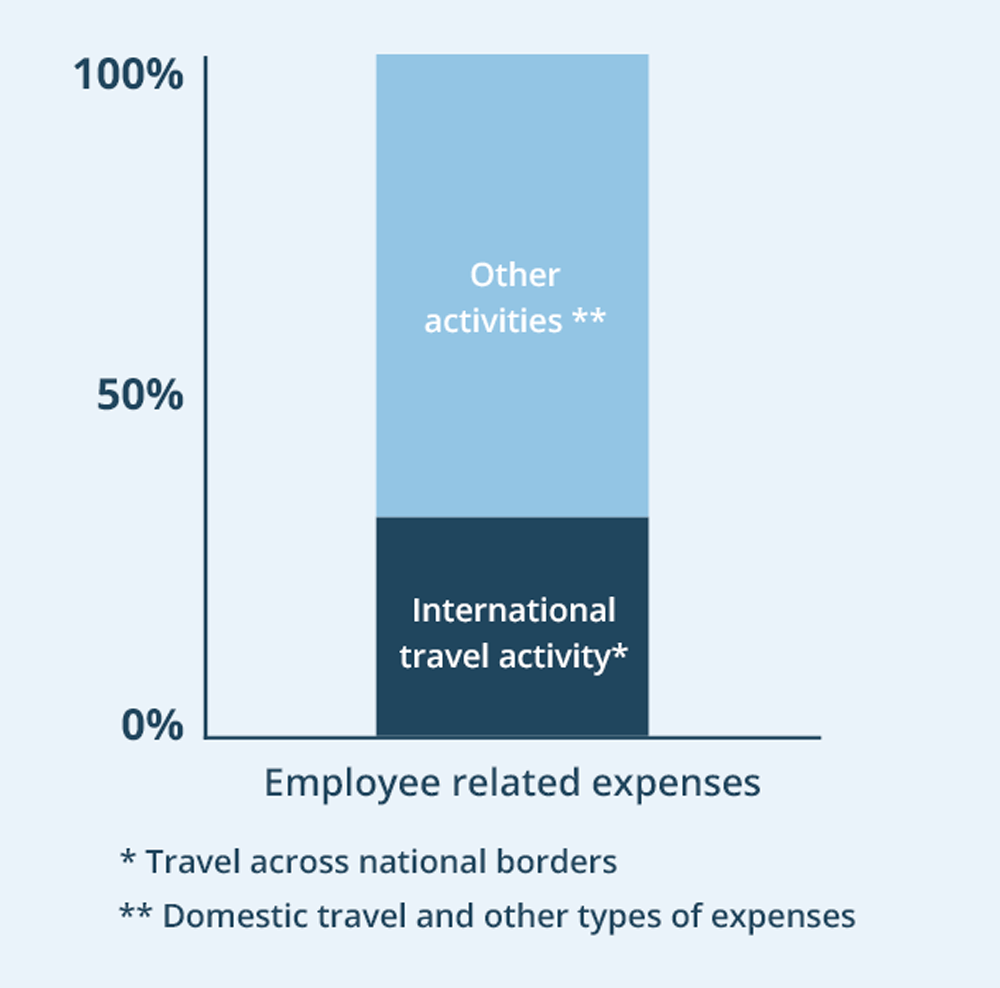

I know that it takes time, but I’m constantly pushing my marketing department to change this image, i.e. that Acubiz per definition is associated with travel expenses. The interesting thing is, however, that we can see from our customer and user behavior with the solution, that it has proven its eligibility far across expense management that’s solely travel related, including international travel activity. We’ve analyzed the use of our solution during the Corona-period so far and compared with usage data (for the same customers) in the corresponding period last year. During the lockdown in March and April, we obviously registered a significant drop in the number of expense transactions that were processed in the solution, due to the sudden suspension of much activity. What’s even more interesting is that we’re back and are registering a consistently stable level of approximately 70 % of the transaction volume in our system with a like-for-like comparison on customer level. The missing 30 %, so to speak, on the respective customers is mainly related to the customers’ international travel activity.

The point is that a system like ours embrace many other types of employee-initiated expenses apart from those that only has to do with international travel activity. A fair share of the active transaction volume is related to domestic travel activity and a broad range of many other types of expenses, that, with great advantage, can be managed in the solution.

From travel expense reporting to general expense management

We continuously analyze the usage of Acubiz and we already knew that many of our customers have seen the light and uses our solution for much more than travel related expenses. COVID-19 has completely changed the conditions for business travel, and while I believe that the international travel activity will resume at some point, I also believe that this sector will see several permanent changes. I’ll get back to that in my next blog post about “The New Normal”. For now, the point is that finance decision makers should think general expense management instead of travel expense reporting. The need is there – even though international travel activity is currently at a minimum.

When I’m explaining this to others, I usually exemplify by using the housing associations that we have among our customers, like KAB for example. In these cases, a good amount of the users is the janitors and caretakers who’re working at the properties. They use Acubiz, for example if they need a package of screws to fix a broken door handle. They simply go to the department store and buy the screws or whatever else they might need to do a specific task and then they “expense” that purchase. This happens on-the-spot – digitally and with all necessary documentation. And you have to say, that as a user profile a janitor is quite far from the typical business traveler – but the need for efficient expense management is, as I said, still there.

This is simply about digitizing and automating the administrative process related to all types of expenses that’re initiated by employees, when they do their jobs. We’ve all experienced how the COVID-19 pandemic turns a lot of things up and down for citizens and businesses, but one thing is for sure; digitization and automation of the ways we’re working won’t be stopped by COVID-19! If you, as a business, choose to stop or delay digitization projects based on wrong assumptions, you’ll risk putting yourself in an undesirable position compared to those who’re cracking on with their digitization efforts.