Especially if the handling of the expenses takes place manually, and as the title suggests, this blog post is aimed at precisely those companies. Unfortunately, a surprising number of companies still use manual workflows for just that.

Our Swedish colleagues at Findity have developed a report in 2024, which shows that only 23% of Danish companies in 2023 were using an expense management system. The number might be even lower. Our research indicates that 61% are still handling expenses manually.

Regardless of the exact figure, it seems reasonable to conclude that many companies still manage expenses manually today.

Handling travel settlements is expensive and time-consuming

When we talk manual handling of expenses, it is inevitable not to mention “travel settlement” in the same sentence. That is hereby done.

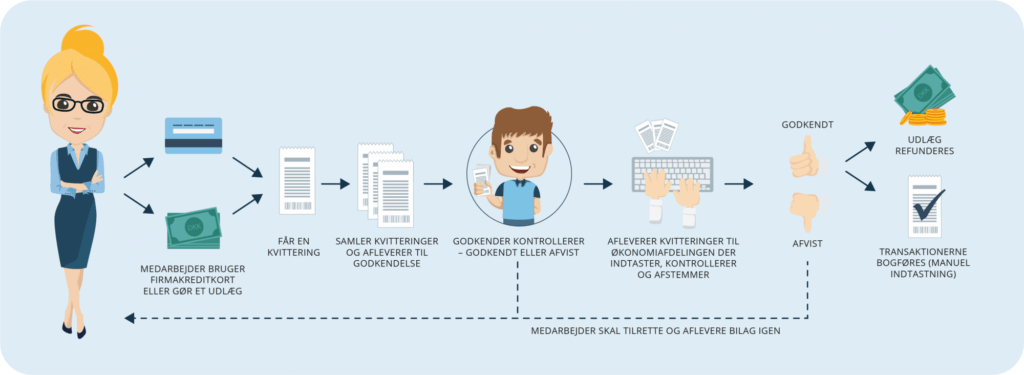

Most of the companies that handle expenses manually make use of the classic travel settlement. The workflow with travel settlements is as follows: you collect costs and receipts related to a given activity. Next, the travel invoice is handed in, hand-carried to a manager for approval, and finally, it gets carried to the finance department, which enters it into the financial system.

You might be thinking that it sounds complicated. It is. It is difficult and time-consuming for the employee, the approver, and the finance department. In addition to being difficult, it is also expensive.

Why is manual expense management expensive?

Managing expenses manually is expensive for two reasons:

- Number of employees involved and the time used

- The possibility of error

The old saying, “time is money,” still holds true. Also, when the conversation falls on travel settlements, according to The Global Business Travel Association, it takes approx. 20 minutes to complete a travel settlement. We think that fits very well. An employee and financial officer will always be involved, while an approver often is. Assuming all these people have an hourly wage, one-fifth of that hourly wage can be considered a cost of handling the expense.

There is also the possibility of errors occurring. The same report concludes that one out of five (19%) travel settlements include errors (missing information, incorrect entry, unclear attachments, etc.). It costs additional money and 18 minutes of extra time.

What does manual handling of travel settlements cost?

The cost associated with travel settlements varies depending on who you ask. Finding one figure that can be considered the average cost is impossible. Various reports around the internet write anywhere from $16 to $58.

An old but often-cited 2011 report by the Aberdeen Group estimates the cost associated with handling a travel settlement at $29.38, while The Global Business Travel Association estimates the cost at $58.

What is right and what is wrong? We don’t have numbers on that ourselves. We think it is most fair to proceed conservatively. Therefore, we use $30 as a benchmark in our calculations – a figure which we also believe is very realistic.

The formula for calculating the cost is simple:

The cost of the travel settlement

x

number of employees

x

the employee’s number of average travel settlements per month

As mentioned, we use $30, assuming each employee has an average of one and a half travel expenses per month. For the sake of simplicity, we have prepared examples with 10, 50, and 100 employees (who all make travel settlements).

In the calculation examples, the time used for error correction is omitted.

- Company with 10 employees:

A company with 10 employees spends $450 per month handling travel expenses. In the Danish kroner, this is DKK 3,140 per month and DKK 37,680 per year.

- A company with 50 employees:

A company with 50 employees spends $2,250 per month handling travel expenses. In the Danish kroner, this is DKK 15,700 per month and DKK 188,000 per year.

- A company with 100 employees:

You don’t have to be a mathematics professor to calculate that the company with 100 employees pays twice as much as the company with 50 employees. That is DKK 31,400 per month and DKK 376,000 per year.

What about all the hidden costs?

In addition to the obvious high financial costs, several hidden costs and disadvantages also follow from manual handling of expenses.

- First, you have to deal with a mountain of receipts.

- Second, receipts can easily get lost.

- Thirdly, your employees spend a disproportionate amount of time on something that does not create value.

- Fourth, tracking whether employees comply with any guidelines and policies is challenging.

- Fifth, the risk of fraud with the expense vouchers is unfortunately greater.

So, what is the solution?

The solution is to find a system that can digitize and automate the entire process from start to finish. We can do that at Visma Acubiz. And we have been doing that since 1997.

We can understand that travel settlements make sense if you, as a company, do not have a system to handle expenses. In this way, all the attachments are “collected.” With Acubiz, we recommend working with our “Fast Track” concept, which involves the user processing and finalizing the expense as soon as it occurs. Then the expense is settled immediately, and it does not, for example, become overwhelming for the finance department at the end of the month when they have to handle all travel settlements simultaneously.

Let’s compare the figures from the calculation examples with some of our own customers. It can be concluded that there is a significant amount of money to be saved by acquiring a digital and automated solution for expense management.

In most cases, you can save 66% or even more by saying goodbye to manual workflows.

Then there is nothing left but to say: get started!