At Acubiz we are on a mission. A mission, where the target is to ease up administrative processes for businesses and their employees. This can be done in many ways and our core area is Expense Management.

Expense Management is about the business-related expenses, that many employees have when they are doing their jobs. Paradoxical and quite funny however, is that every time an employee has an expense, more work related to documenting, justifying, controlling, approving, bookkeeping, accounting and sometimes settling the expense occurs. Our goal is to digitize and automate the end-to-end journey of the expense transaction, from the moment it occurs, to the moment it is entered in the books.

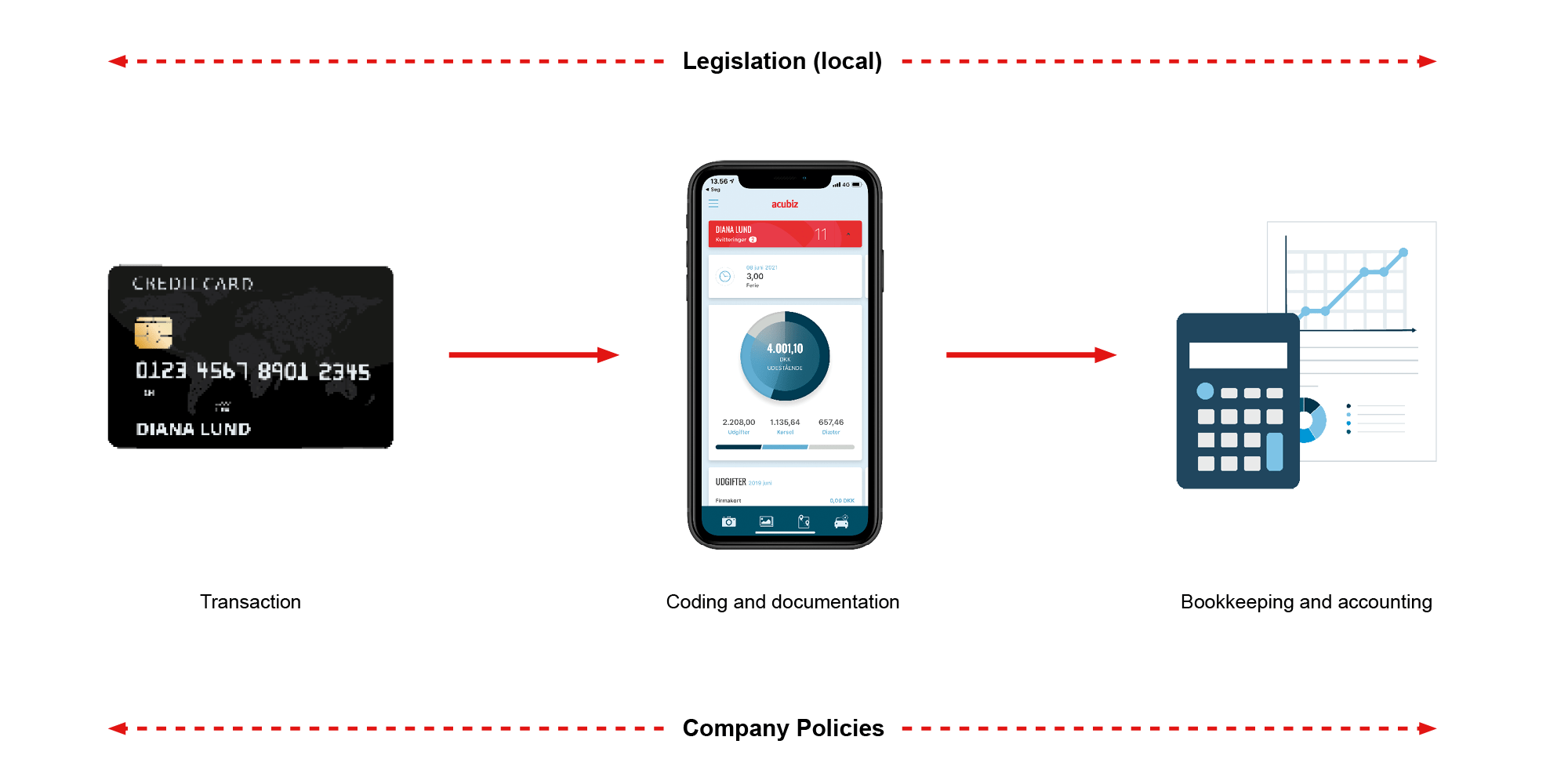

In this blog post, I will concentrate on the expenses, that are paid with corporate cards and I will explain how you can create an full digital value chain around the journey of an expense – from transaction to bookkeeping.

The black holes

This section headline and the term “black holes” related to corporate card transactions comes from our friend, Lars Kristoffersen. Lars works as a Cash Manager at Nordea, and, amongst other things, he provide advisory to business clients around the usage of corporate cards. Recently, Lars used this analogy at a session we had with Nordeas Cash Management team about our joint offer with First Card and Acubiz, and I think that it is spot on.

As I initially described, more work occurs every time an employee uses a corporate card. The work is related to enriching each transaction with the information that is required, in order to bookkeep the expense correctly. This is both related to legal requirements and specific company related requirements and rules. So, to use Lars’ words, the missing information can be described as “black holes” and the data enrichment for each transaction is simply about filling the “black holes”.

When expenses are paid with a corporate card, certain pieces of information are already available digitally. This is for example information like transaction date and time, currency and merchant information (through MCC codes). Obviously, these data come in handy in the continued journey towards the bookkeeping phase, but still additional pieces are needed.

What type of information can be characterized as black holes then? Well, if we start with the legal aspect, then the receipt for a given expense is important. According to Danish bookkeeping law, the expense receipt or a copy of it (it can be digital) must be stored for 5 years. The other “black holes” relates to each organizations structure and requirements for bookkeeping and additional documentation related to expenses. The actual bookkeeping work can span from following a simple chart of accounts to be more complex, for example with allocation requirements for specific departments, projects or customers, given the complexity and structure related to financial dimensions. Apart from this, there can also be “black holes” related to documentation for the approval of expenses – typically from employees through one or multiple managers.

If we jump back to the bookkeeping and accounting work, then this is a task, that traditionally lies within the finance department. However, when it comes to expenses paid with corporate cards, I suggest that this task is delegated to the cardholder – the “black holes” should be filled the moment an expense occurs.

A digital value-chain

How do you create the digital value chain, that connects your corporate cards with your ERP or finance system? And how can your employees handle bookkeeping and accounting of their expenses themselves? Well, you do that by finding a tool that can:

- Fetch transaction data from your corporate cards.

- Facilitate that the user / cardholder, through simple actions, can fill the “black holes”.

- Deliver bookkeeping-ready data for your ERP or finance system.

Obviously, it is here that a solution. like ours enters the stage and the illustration below outlines the chain.

When you look for at tool that can help you create this chain, there are many things to research and consider. But for a start, it is important that you think about the following:

- Usability – the tool must be easy and intuitive to work with, otherwise you will never have salespeople, consultant etc. do expense bookkeeping and accounting for you.

- Security – remember that the tool will process payment card and transaction data. This needs to happen securely.

- Features and integration options – look at your other employee related expenses, for example related to mileage or private outlays for employees without corporate cards. Make sure that the solution has features and perspective to handle multiple things. Integration options are obviously important – if the tool cannot connect to your specific corporate cards or your specific finance system, then you are back to square one.

You probably know how, like salespeople normally are and then you might ask an extra time, whether it “really is possible” to have them do correct bookkeeping of expenses? Well, the answer is yes, it is fully possible, provided it is done the right way. Check out what Per Baltsen, who is CFO at Dansk Brandteknik A/S has to say about that.

“Technology packed card”

An Expense Management solution has many facets, but one angle that I often apply, is that it will enable you to give your corporate cards more power – even superpowers! You will literally upgrade the cards with some technology. Technology, that makes the cards more intelligent. Technology, that makes it easy to fill the black holes. Technology, that will enable you to create the chain that I have outlined in this blog post. Technology, that will save your company a lot of time – both in the finance departments and with the users / card holders.

Put in another way, when we talk about the expenses that are paid with corporate cards, the cards will handle most of the bookkeeping for you! The cards will also help your salespeople, consultants and other users to keep track of their receipts and expense documentation.