Businesses often ask us for advice about card payment solutions for their employees. There are different types of solutions available in the market, but it is far from everyone that has the full overview of the differences. Even more important, it is only few who knows the actual implications for a business and its employees, that a given card solution can have. I have outlined the main differences, pros and cons related to the two common card types available in the market.

Debit cards and credit cards

In general, there are two types of payment cards: debit cards and credit cards. Both types are basically accepted as payment option most places if they are issued within one of the large platforms (for example MasterCard or VISA). That said, there are a few important factors you need to consider here, which I will touch upon later. However, the main difference relates to when your cash position will be strained.

Debit cards are directly linked to an account in a bank or they are so called “prepaid”. When the card is used the amount is withdrawn directly from the account (or the prepaid balance). This typically happens in real-time or day to day. Basically, this means that, if there aren’t available funds, the card cannot be used. However, there are typically options to set up automatic refills or options for overdrawing.

On the other hand, we have the credit card. This card type is based on a credit line for your business from the card provider. The usage on the cards is due to payment later, typically by the end of the month. This means that you borrow the money interest free in a period of 30 to 45 days depending on the agreement with the card provider.

Debit cards – pros and cons

The advantage of debit cards is, that it is only possible to complete transactions if the balance on the linked account is positive. This provides control over the funds and it is not possible to spend cash that is not available. In some cases, a debit card can be overdrawn but then the overdrawn amount will be ascribed a high interest rate.

You need to be aware of the following:

- Balance administration: You’ll continuously secure that there is funds available on the linked account (however, some solutions offer the option to set up automatic account refill).

- Some merchants simply don’t accept debit cards: Such as hotel reservations and car hire if the transaction implies reservation of money as security.

- Security in terms of theft and fraud: If a card or a user’s card information is stolen or misused, the liquidity of your business will be strained immediately. Banks and card providers typically offer some sort of protection but it is still your liquidity that is strained. Moreover, your business often carries most of the liability for the loss.

- Payment for certain services: If some employees are using their debit cards to pay for services like software subscriptions or digital advertising (Google Ads, LinkedIn, Facebook etc.) where automatic payments typically are set up, you need to have an extra eye on balance administration. If there is no cover for the transactions, the subscriptions and advertisements will stop, which in worst case can be business critical.

- Add-ons and perks: Some debit cards don’t have options for add-ons and perks – for example insurances, lounge access and discounts.

- Overdrawing: Carries interest and is expensive.

- Cash withdrawals: Is possible, but only if there is enough balance.

Credit cards – pros and cons

As mentioned, this type of card comes with a credit line for your business. You will then settle the sum of transactions with intervals, typically on a monthly basis. During the credit period, the balance doesn’t carry interest if you pay the balance in full. A credit card solution also provides a high level of security against theft and fraud because you have more time to react on suspicious transaction before they hit your company’s liquidity. In addition, it is often possible to establish insurance against fraud as a part of most credit card solutions. With credit cards comes also the option of various additional services and perks that can benefit your business and employees.

You need to be aware of the following:

- Discipline with balance payment: Partial payments of the balance means interests and debt can accumulate if the balance isn’t paid in full.

- Credit worthiness: It can be a challenge for some businesses to obtain approval of enough credit line.

- Cash withdrawals: These transactions are typically subject to fees.

What type of card should you choose?

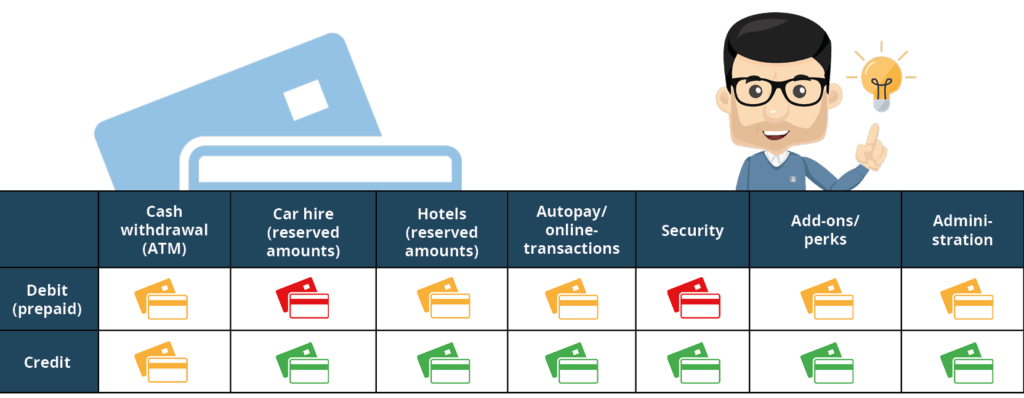

There are pros and cons with both debit and credit cards. I have summarized the main points in the table below with a score on several important factors (green = best):

It is important to consider that your choice of card solution can affect your employee’s efficiency. It is perhaps difficult to measure, but fact is that employees can get caught in situations where their available payment solution can limit them in doing a task in the most efficient way. To sum up, I reach the conclusion that with the right amount of control a credit card solution gives more advantages, better security and greater flexibility for your business and your employees. If you go further and choose to combine a credit card solution with a fully digital expense process, I guarantee that you will get an extremely strong and efficient tool – for the benefit of your whole business.